Posted by: Northwest Eye in General on June 30, 2025

Overview

We understand that considering LASIK surgery can be a significant decision, especially when it comes to financial aspects. The article primarily addresses a common concern: whether insurance covers LASIK surgery. It’s important to note that LASIK is often viewed as an elective procedure, which means it typically isn’t covered by standard health insurance plans.

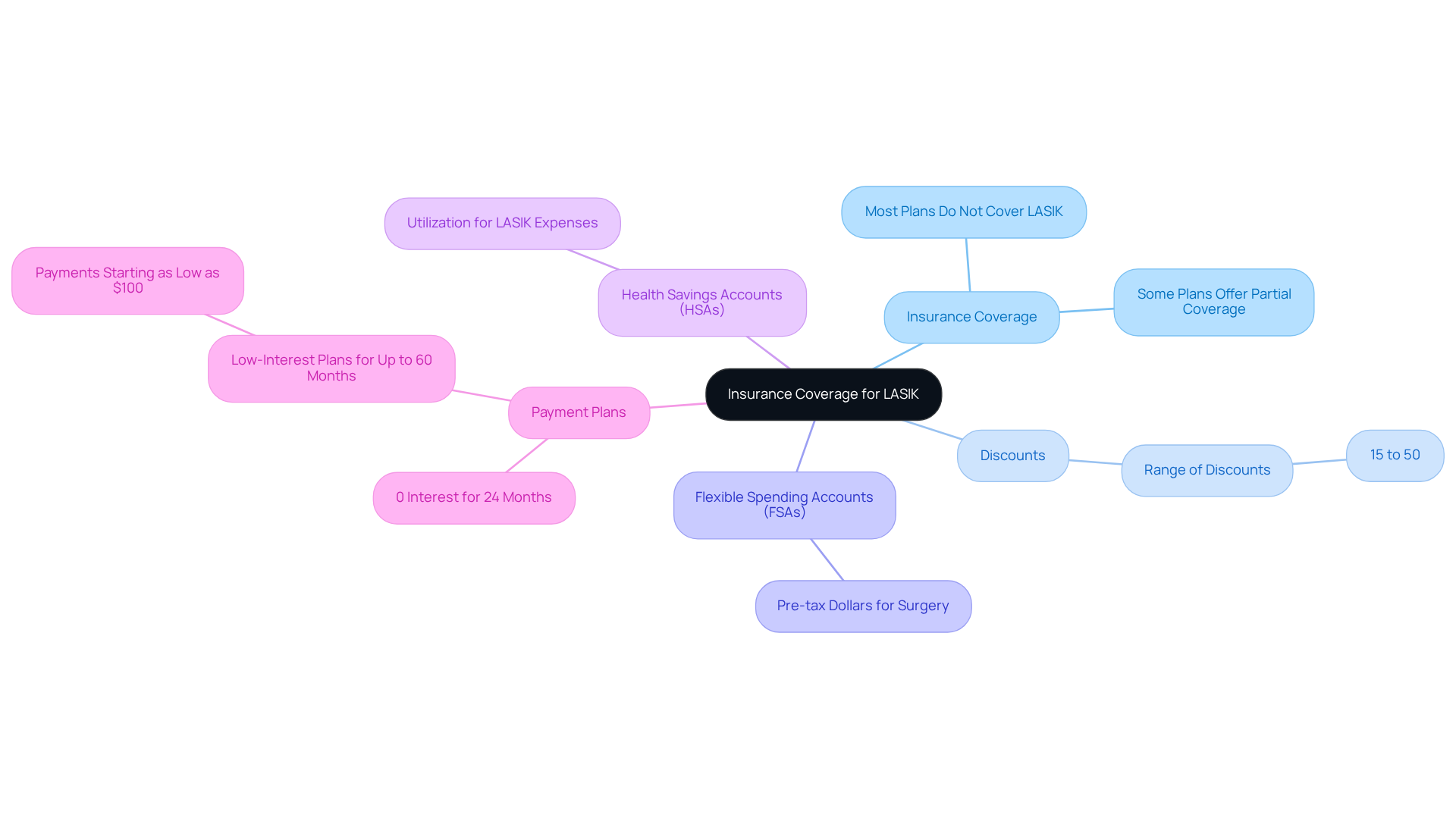

However, some insurance policies may offer partial coverage or discounts, so it’s worth checking your specific plan. Additionally, there are alternative payment methods available that can help manage the costs of the procedure. Options such as:

- Flexible spending accounts (FSAs)

- Health savings accounts (HSAs)

can provide financial relief. Financing options are also available, making it easier for you to consider this life-changing procedure.

We are here to help you through this process and encourage you to explore all available resources to make an informed decision. Remember, you’re not alone in this journey, and there are ways to make LASIK surgery more accessible.

Introduction

Understanding the intricacies of LASIK surgery can feel overwhelming, particularly when financial considerations come into play. Many individuals seeking to correct their vision may wonder: does insurance cover LASIK? It’s common to feel uncertain, especially since traditional health insurance often views this surgery as non-essential. However, there are various options and alternatives that could help ease the financial burden.

We understand that exploring hidden opportunities within insurance plans or innovative financing methods can seem daunting, but these avenues may be the key to achieving clearer vision without overwhelming costs. We are here to help you through this process.

Define LASIK Surgery and Its Elective Nature

Laser-Assisted In Situ Keratomileusis is a widely used refractive eye surgery designed to address vision issues such as nearsightedness, farsightedness, and astigmatism. We understand that considering surgery can be daunting, and it’s natural to have questions and concerns. This procedure reshapes the cornea with a laser to improve how light is focused on the retina, ultimately enhancing your quality of life by reducing or eliminating the need for glasses or contact lenses.

It’s important to note that this is an elective surgery, which leads to the question of does insurance cover lasik, as it is not considered medically necessary. As a result, it may not be covered by typical health insurance plans, which raises the question of whether does insurance cover lasik and can lead to uncertainty about financial obligations. We encourage you to consult with your insurance provider to confirm whether does insurance cover lasik and if we are in-network for laser eye surgery services.

At Northwest Eye, we genuinely care about making your experience as smooth as possible. We offer a variety of funding options and payment plans to help manage the cost of care. Understanding your insurance benefits and exploring our financing alternatives can significantly alleviate worries about expenses. Remember, we are here to help you through this process and support you every step of the way.

Explore Insurance Coverage Options for LASIK

We understand that navigating health insurance can be overwhelming, particularly regarding whether insurance covers LASIK for procedures like laser eye surgery. Many people wonder, does insurance cover LASIK, as most health insurance policies do not cover this treatment because it is often viewed as non-essential. However, there is hope—some plans may provide partial coverage or discounts. For instance, many vision insurance companies offer discounts on eye surgery, typically ranging from 15% to 50%.

It’s important to check with your specific insurance provider to fully understand if insurance does cover LASIK and your coverage details. Additionally, some employers offer flexible spending accounts (FSAs) or health savings accounts (HSAs) that can be utilized to cover LASIK expenses. This allows you to use pre-tax dollars for your surgery, which can be a significant financial relief.

At Northwest Eye, we care about making your journey as smooth as possible. We offer payment plans for qualified candidates, including 0% interest options for up to 24 months through CareCredit and low-interest plans for up to 60 months, with payments starting as low as $100 per month. Before proceeding with your surgery, we encourage you to ask, does insurance cover LASIK, and explore these financing options to maximize your savings. We are here to help you through this process and ensure you feel supported every step of the way.

Identify Alternative Payment Methods for LASIK

For patients concerned about whether insurance covers LASIK, we understand that managing costs can be a concern. Fortunately, there are several alternative payment methods that can help make this important procedure more accessible:

- Flexible Spending Accounts (FSA): You can utilize pre-tax dollars set aside in an FSA to cover LASIK expenses. This approach not only reduces your overall tax burden but also allows you to designate resources specifically for medical treatments, including eye surgery. FSAs typically permit contributions of up to $2,850 annually, which can be used for vision correction expenses.

- Health Savings Accounts (HSA): Similar to FSAs, HSAs allow you to save pre-tax funds for qualified medical expenses, including LASIK. Contributions to HSAs can grow tax-free, and withdrawals for qualified expenses are also tax-free. The maximum contribution limit for HSAs in 2025 is $3,650 for individuals and $7,300 for families, providing a dual advantage in managing healthcare costs.

- Payment Options: At Northwest Eye, we offer flexible payment alternatives that enable you to cover costs in manageable installments. Financing companies often provide quick approvals, with qualified applicants receiving financing within 24 hours. You can anticipate set payment sums and conditions, assisting you in planning for treatment without the worry of accumulating high-interest debt. Just be mindful that late payments may incur penalties, including the loss of low or no-interest rates.

- Personal Loans: Another option is to consider personal loans to cover the procedure’s expenses. These loans can be structured with flexible repayment terms, allowing you to pay back the borrowed amount over time, easing the financial burden. However, it’s important to be cautious of potential late fees and adverse credit reports if payments are missed.

- Promotions and Discounts: Some vision correction providers, including Northwest Eye, offer seasonal promotions or discounts for new clients. These can significantly decrease the overall expense of the procedure. We encourage you to research and compare various financing options and promotional offers to find what best fits your financial situation.

By exploring these alternative payment methods, you can make LASIK more accessible and manageable, while also asking if insurance covers LASIK, ensuring you receive the vision correction you need without undue financial strain. We are here to help you through this process.

Conclusion

Laser-Assisted In Situ Keratomileusis (LASIK) surgery offers a wonderful opportunity for those looking to improve their vision. However, we understand that it also raises important questions about insurance coverage. As an elective procedure, LASIK often falls outside the typical health insurance plans, leading many to wonder about their financial responsibilities. It’s crucial to grasp the nuances of insurance coverage and the financing options available when considering this transformative surgery.

This article delves into the complexities surrounding LASIK surgery and insurance coverage. While many health insurance policies do not cover the procedure, some may provide partial coverage or discounts. We emphasize the importance of consulting with your insurance providers and exploring alternative payment methods, such as:

- Flexible Spending Accounts (FSAs)

- Health Savings Accounts (HSAs)

Additionally, financing options like payment plans and personal loans can serve as viable solutions for managing costs effectively.

Ultimately, we believe that the journey to improved vision through LASIK should not be hindered by financial concerns. By actively seeking information about insurance coverage and exploring various payment options, you can take significant steps toward achieving your vision goals. Empowerment through knowledge is key; considering LASIK surgery can greatly enhance your quality of life, and with the right financial planning, it can become a reality for many. We are here to help you through this process.

Frequently Asked Questions

What is LASIK surgery?

LASIK, or Laser-Assisted In Situ Keratomileusis, is a refractive eye surgery designed to correct vision issues such as nearsightedness, farsightedness, and astigmatism by reshaping the cornea with a laser.

Is LASIK surgery elective?

Yes, LASIK surgery is considered elective, meaning it is not classified as medically necessary.

Does insurance cover LASIK surgery?

LASIK surgery is typically not covered by standard health insurance plans since it is elective. It is advisable to consult with your insurance provider to determine coverage specifics.

What should I do if I have questions about insurance coverage for LASIK?

You should contact your insurance provider to confirm whether they cover LASIK surgery and check if the surgery center is in-network for laser eye surgery services.

What financial options are available for LASIK surgery?

Northwest Eye offers various funding options and payment plans to help manage the costs associated with LASIK surgery, making it easier for patients to afford the procedure.